Frictionless KYC

& Onboarding

Intelligent data to onboard and monitor any business, fast.

Arachnys accelerates onboarding by providing the best global KYC and AML data. Enriched, automated data enables straight-through processing and means fewer customer touchpoints, less risk and quicker revenue.

Industry-wide problems

Banks are losing money because the ‘time to revenue’ for customer onboarding is too long. The overall onboarding time for corporate banking customers is a staggering 90-120 days* (Oliver Wyman).

Banks are still relying on huge compliance teams to manually deal with remediation backlogs and ongoing monitoring issues. There's now an average of 307 deployed KYC employees* (Thomson Reuters).

The onboarding and review processes cause friction resulting in a poor customer experience. 85% of corporates have not had a good KYC experience, resulting in 12% changing banks* (Thomson Reuters).

The Arachnys Advantage

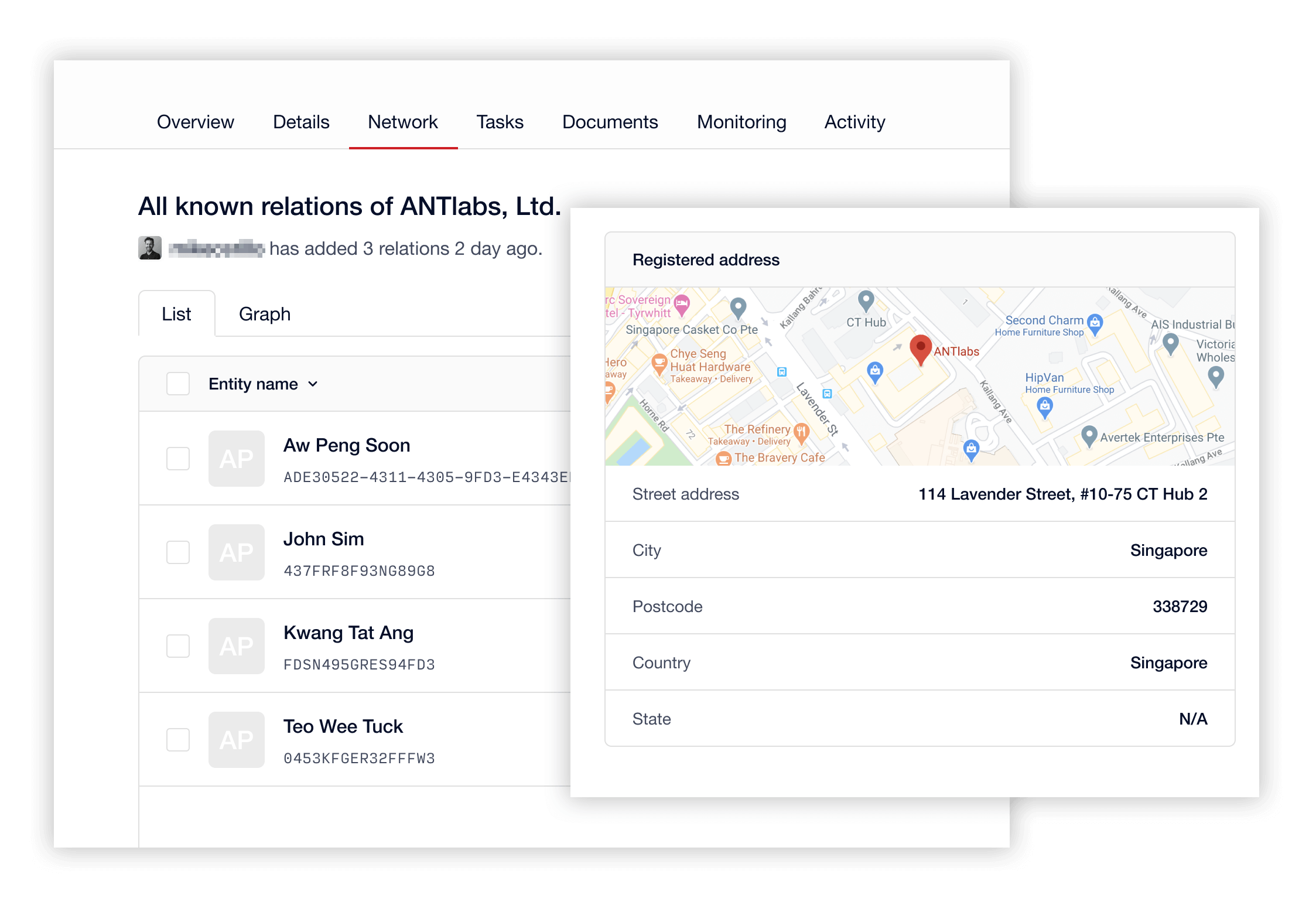

Faster entity resolution

Leverage existing data

Reduced manual effort

UBO identification

Rapid deployment

Easy integration

Features

White Paper: Achieving Perpetual KYC

How close is the financial world to achieving perpetual KYC?

Oliver Wyman shared with us their Global KYC benchmarking study on Global Banking & Markets KYC, which has found that the overall onboarding time for corporate banking customers is a staggering 90-120 days.

In this white paper, , we look at how banks can reduce onboarding times, KYC refresh costs and improve the customer experience by leveraging better technology and automation across the three pillars of data:

- Driving efficiency with self-reported customer data

- Using automation to capture & screen external data

- Reducing risk through monitoring transaction behaviour

Follow our AML & KYC Blog

-

2022 Financial Crime Market Outlook | Africa & Middle East

In this part of our global anti-money laundering outlook, we are delving into Africa and the Middle East and what

-

2022 Financial Crime Market Outlook | Latin America

Welcome back to our 2022 outlook on the AML industry across different parts of the world. In this part, we’re

-

2022 Financial Crime Market Outlook | APAC

Our next foray into the complex financial crime compliance industry is looking into APAC. In a report published by Business